Tax Preparer Certificate Overview

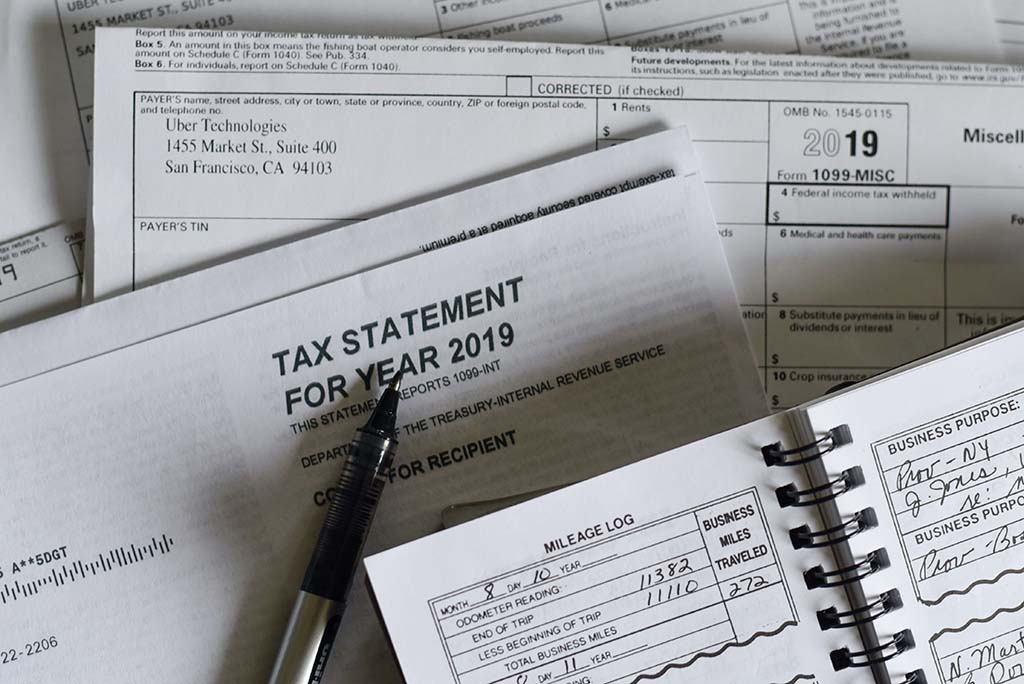

Students who enroll in the Tax Preparer certificate program acquire fundamental accounting skills including preparation and interpretation of financial statements, managing accounting processes for a business using QuickBooks, and preparing tax returns. These skills are taught by faculty who have extensive and current real-world experience in the fields of Business and Accounting, using technology-driven education principals. Students are prepared for employment in entry-level accounting positions and are equipped to use technology for both accounting processes and tax preparation. Upon completion of this certificate students can sit for the QuickBooks Certified User Examination.

The Rhodes State Tax Preparer certificate program also offers flexibility and is offered in a traditional day-time or a 100% online format. Every course in the Accounting Clerk Certificate can be applied to the Associate’s Degree in Accounting at Rhodes State for students that wish to further their education in accounting.

Tax Preparer Certificate Highlights

- Tax Preparer Certificate is offered in a traditional day time and a 100% online format.

- Faculty have extensive and current real world experience in the fields of Business and Accounting.

- Every course in the Accounting Clerk Certificate can be applied to the Associate’s Degree in Accounting at Rhodes State College for students that wish to further their education in accounting.

Career Opportunities

Those with Rhodes State tax preparer certificates are prepared for careers as tax preparers, bookkeepers, accounts receivable clerks, accounts payable clerks, and financial accountants.

Tax Preparer Certificate Plan of Study

Professional Licensure Information

QuickBooks Certified User